With a rich heritage of innovation and a proven record of financial success, Goodyear has firmly positioned itself as a frontrunner in the tire industry. But what lies at the heart of this iconic brand’s enduring appeal and accomplishments? Rerev delves into the company’s beginnings, its most remarkable milestones, and the key elements that have made it a household name among drivers across the globe. Both tire enthusiasts and those interested in manufacturing will find this engaging and informative exploration of one of the industry’s leading pioneers unmissable.

- Goodyear’s worldwide revenue in 2022 is one of the highest, with a total of USD 20.8 billion.

- The Goodyear Tire & Rubber Company holds dominant majority ownership of 66.87% in the shareholder structure, with the remaining percentage divided among nine other entities, none exceeding 5.66% individually.

- The Americas is a significant market for Goodyear, with a strong production presence and extensive distribution network.

- There is a significant recovery in Goodyear’s annual gross profit from a dip in 2020 and a consistent growth trend over the years.

Table of contents

Michelin history timeline

In 1898, David Hill acquired almost one-third of the $100,000 worth of shares, becoming the organization’s inaugural president.

The first Goodyear manufacturing facility was established in Akron, Ohio.

The company expanded into the aviation sector, manufacturing the inaugural airplane tires.

The company expanded its operations outside the United States for the first time by establishing a plant in Canada.

The company also pioneered the creation of the first bullet-resistant fuel tank for aircraft.

Aiming for international expansion, the company pursued and established operations in countries such as Canada, Australia, Argentina, and the Dutch East Indies.

The company operated in 145 countries and sales reached $250 million.

Seeking further growth, the company acquired Kelly-Springfield, a tire manufacturer.

Swedish plant was opened.

Sales rose by 52%, demonstrating Goodyear’s involvement in the United States military defense program.

The first nylon tires were developed for the consumer market.

Goodyear achieved the significant landmark of manufacturing its one-billionth tire.

Goodyear became the leading tire sales enterprise in the United States.

Sales surpassed the $3 billion mark.

Radial tires were fitted on 45% of cars in the United States, and Goodyear had become the world’s largest producer of radial tires.

Worldwide sales exceeded $10 billion.

Goodyear entered into a business collaboration with Canadian tire retailer Fountain Tire.

Goodyear experienced its first net loss since the Great Depression.

Goodyear had successfully managed to decrease its long-term debt to a more manageable $1.47 billion.

Goodyear achieved all-time record sales of $12.3 billion, along with a record income of $567 million.

Goodyear declared its exit from Formula 1 racing.

The company reported a record net loss of $1.25 billion, pushing the firm to the brink of bankruptcy.

Goodyear launches online tire sales in the United States.

Goodyear and Bridgestone revealed the establishment of TireHub, a collaborative wholesale distribution network throughout the United States.

Goodyear declared its intention to purchase Cooper Tire & Rubber Company for a sum of $2.5 billion.

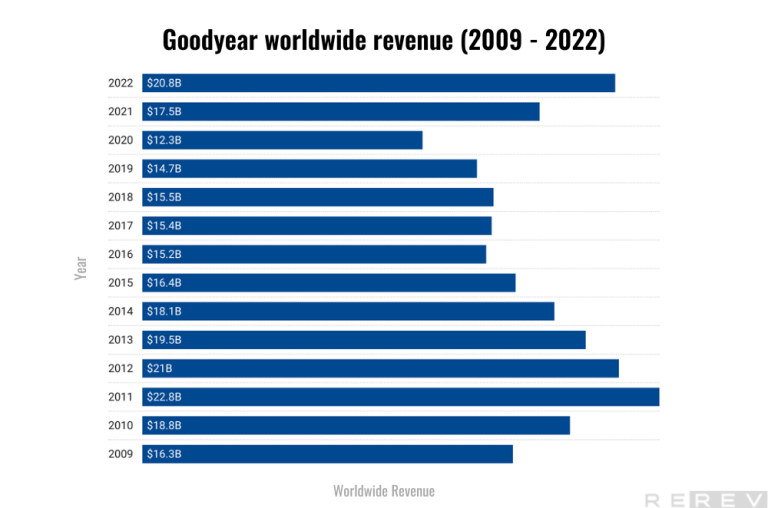

Goodyear worldwide revenue statistics

- Goodyear’s annual revenue showcases a remarkable recovery in 2021 and 2022, nearly reaching the levels experienced in 2012.

The company has made a substantial financial recovery between 2020 and 2022. In 2020, Goodyear’s revenue stood at $12.32 billion, which increased by over $5 billion to reach $17.48 billion in 2021, and continued its upward trajectory to reach $20.81 billion in 2022. This impressive growth in a span of just two years highlights the company’s ability to bounce back and regain its market strength after facing a dip in revenue.

Moreover, Goodyear’s 2022 revenue of $20.81 billion nearly matches its 2012 revenue of $20.99 billion, indicating that the company is on track to regain its past financial performance.

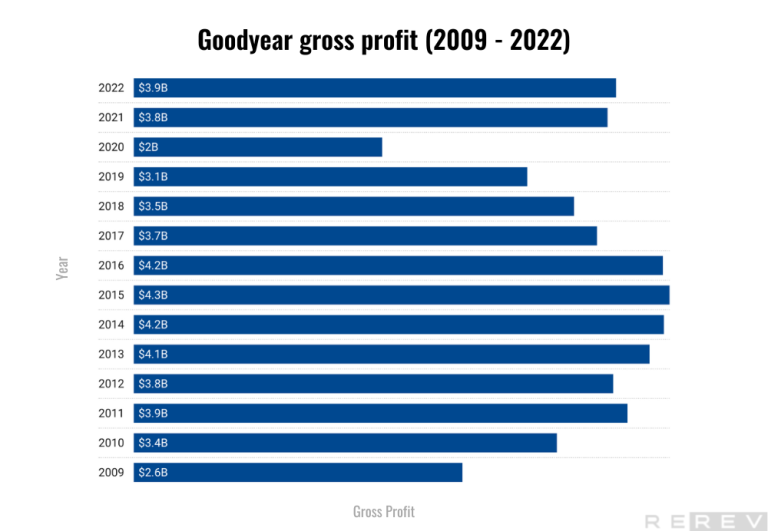

Goodyear gross profit statistics

- There is a significant recovery in Goodyear’s annual gross profit from a dip in 2020 and a consistent growth trend over the years.

In 2020, the company’s gross profit was $1.984 billion, which increased substantially to $3.786 billion in 2021 and further to $3.852 billion in 2022. Apart from the recovery, the data also indicates a consistent growth pattern for Goodyear’s gross profit. Starting from $2.625 billion in 2009, the gross profit increased steadily over the years, reaching a peak of $4.279 billion in 2015. With minor fluctuations, the gross profit remained relatively stable until 2017 before experiencing a dip in 2020.

These findings illustrate Goodyear’s ability to bounce back from challenging financial periods and maintain a strong market presence. The consistent growth trend in the company’s gross profit, alongside the notable recovery from 2020 to 2022, showcases Goodyear’s resilience and potential for continued success in the tire industry.

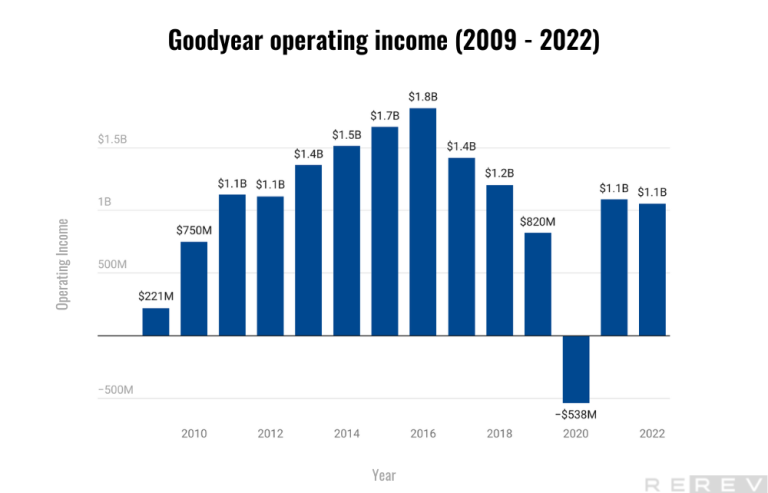

Goodyear operating income statistics

- Goodyear’s annual operating income reveals a notable rebound from a negative figure in 2020 to positive figures in 2021 and 2022.

There is a significant recovery in the company’s financial performance following a challenging year in 2020. In that year, Goodyear reported a negative operating income of $538 million. However, the company managed to turn its fortunes around in 2021, with an operating income of $1.087 billion. This positive trend continued into 2022, as the operating income further increased to $1.054 billion.

The years 2015 to 2017 saw relatively stable operating income, with 2016 having the highest operating income in the provided data, with a total of USD 1.8 billion. Between 2011 and 2014, Goodyear Tire & Rubber experienced a decline in operating income, but it bounced back in 2015 and continued to see growth until 2017. These financial fluctuations demonstrate Goodyear’s ability to navigate a dynamic market environment and adapt its business strategies to maintain a strong presence in the tire industry.

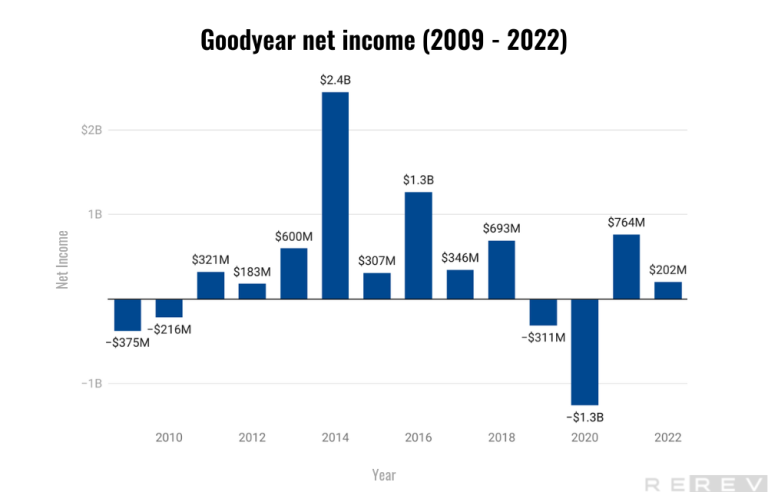

Goodyear net income statistics

- Goodyear’s annual net income demonstrated a significant peak in 2014, with a net income of $2.445 billion and a remarkable recovery in 2021 after experiencing losses in 2019 and 2020.

Goodyear Tire & Rubber Company experienced a notable increase in annual net income between 2010 and 2014, with 2014 being the highest at $2.445 billion. This peak was followed by a decline in net income in subsequent years. The company saw a loss in 2019 with a net income of -$311 million and an even larger loss in 2020 with -$1.254 billion. However, the company made a significant recovery in 2021, with a net income of $764 million. While the 2022 net income of $201 million is lower than the previous year, it still shows the company’s ability to maintain profitability after recovering from losses.

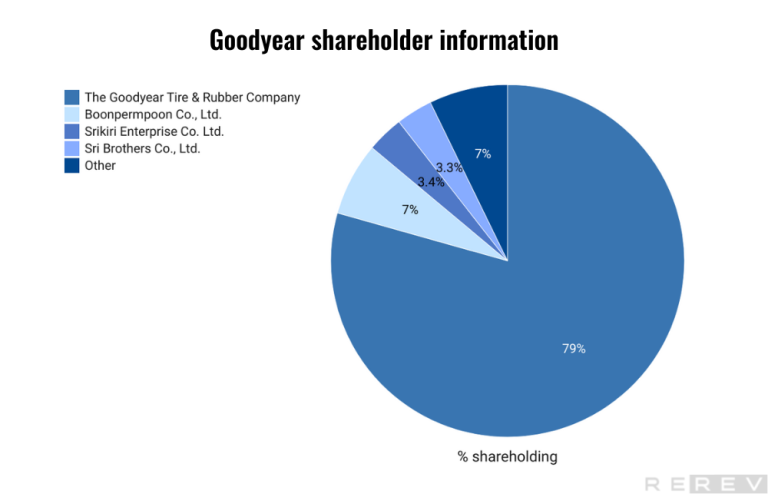

Goodyear shareholder statistics

- The Goodyear Tire & Rubber Company holds dominant majority ownership of 66.87% in the shareholder structure, with the remaining percentage divided among nine other entities, none exceeding 5.66% individually.

The Goodyear Tire & Rubber Company holds a significant majority of the shares, with 66.87% ownership. This dominant position underscores the company’s control over decision-making processes and strategic direction.

The remaining shareholding is divided among nine other entities. Boonpermpoon Co., Ltd. has the second-largest share but at a considerably lower percentage of 5.66%. The other shareholders, including Srikiri Enterprise Co. Ltd. (2.84%), Sri Brothers Co., Ltd. (2.81%), Boon Song Co., Ltd. (1.92%), Thai NVDR Co., Ltd. (1.38%), Techapaibul Co., Ltd. (0.99%), BNP Paribas Securities Services, London Branch (0.87%), Mrs. Dararat Saluk (0.45%), and Worawat Co., Ltd. (0.45%), each hold a relatively small percentage of shares.

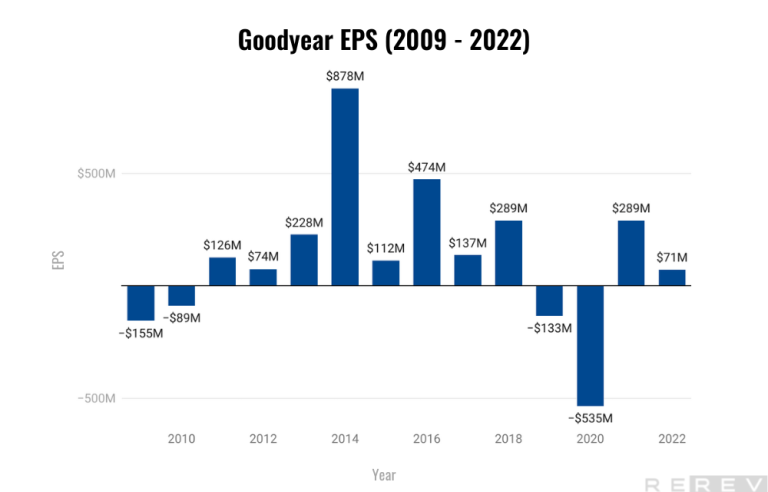

Goodyear EPS statistics

- Goodyear Tire & Rubber Company’s annual earnings per share (EPS) reached its highest level in 2014 at $878 million, followed by a period of fluctuation, with a recovery in 2021 after negative EPS in 2019 and 2020.

Goodyear Tire & Rubber Company experienced a significant increase in annual earnings per share (EPS) between 2010 and 2014, with 2014 marking the highest level at $878 million. Following this peak, the company’s EPS experienced fluctuations in the subsequent years.

In 2019, the company reported a negative EPS of -$133 million, which further worsened in 2020 with an EPS of -$535 million. Despite these setbacks, Goodyear Tire & Rubber Company demonstrated resilience and significantly recovered in 2021, posting an EPS of $289 million.

While the 2022 EPS of $71 million is lower than the previous year, it still indicates the company’s ability to maintain profitability on a per-share basis after recovering from prior losses. The fluctuating EPS over the years underscores the importance of close monitoring and adapting to market conditions and industry trends for the company’s long-term success.

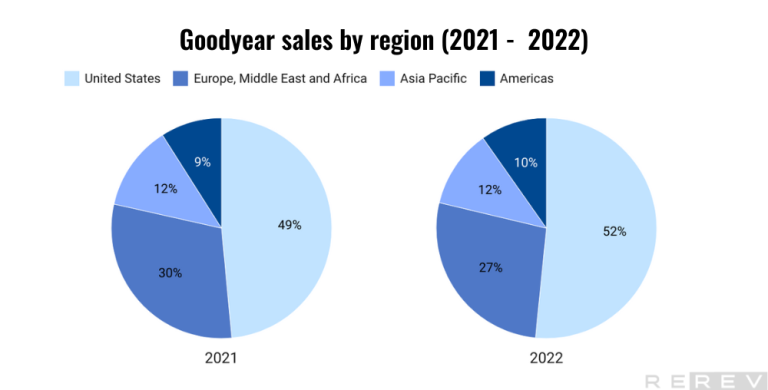

Goodyear sales by region statistics

- Tire unit sales across all regions declined between 2018 and 2020, with the Americas experiencing the highest sales volume each year, reaching 70.9 million units sold in 2018.

Across all regions, there is a noticeable downward trend in tire unit sales during this period. The Americas consistently reported the highest sales volume, with 70.9 million units sold in 2018, 70.4 million units in 2019, and 56.7 million units in 2020.

Similarly, the Europe, Middle East, and Africa (EMEA) region also experienced a decline in sales during this timeframe, with 57.8 million units sold in 2018, 55.1 million units in 2019, and 44.5 million units in 2020. The Asia-Pacific region followed a comparable pattern, with sales of 30.5 million units in 2018, 29.8 million units in 2019, and 24.8 million units in 2020.

The overall decline in tire unit sales across all regions between 2018 and 2020 highlights the challenges faced by the tire industry during this period, potentially due to economic factors, market conditions, or industry trends.

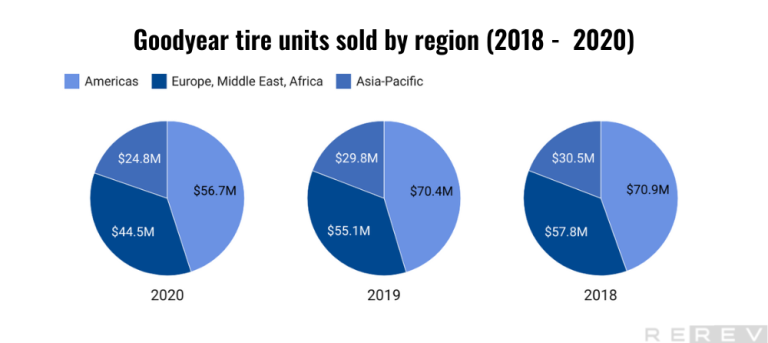

Goodyear tire units sold by region statistics

- Tire unit sales across all regions declined between 2018 and 2020, with the Americas experiencing the highest sales volume each year, reaching 70.9 million units sold in 2018.

Across all regions, there is a noticeable downward trend in tire unit sales during this period. The Americas consistently reported the highest sales volume, with 70.9 million units sold in 2018, 70.4 million units in 2019, and 56.7 million units in 2020.

Similarly, the Europe, Middle East, and Africa (EMEA) region also experienced a decline in sales during this timeframe, with 57.8 million units sold in 2018, 55.1 million units in 2019, and 44.5 million units in 2020. The Asia-Pacific region followed a comparable pattern, with sales of 30.5 million units in 2018, 29.8 million units in 2019, and 24.8 million units in 2020.

The overall decline in tire unit sales across all regions between 2018 and 2020 highlights the challenges faced by the tire industry during this period, potentially due to economic factors, market conditions, or industry trends.

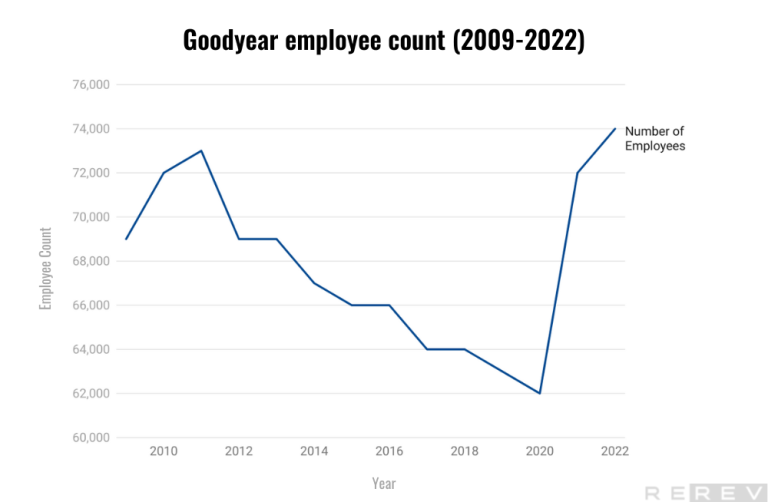

Goodyear employee count statistics

- The number of employees has fluctuated over the years, with a peak of 73,000 in 2011, followed by a gradual decline until 2020, and a recent increase to 74,000 in 2022.

From 2009 to 2022 the company has experienced fluctuations in its workforce size. The highest number of employees was recorded in 2022, with 74,000 people working for the company.

Between 2011 and 2020, the number of employees experienced a gradual decline, reaching its lowest point of 62,000 in 2020. This downward trend could be attributed to various factors, such as changes in the business landscape, cost-cutting measures, or increased automation.

However, starting in 2021, the company began to increase its workforce again, reaching 72,000 employees. This upward trend continued into 2022, with the number of employees rising to 74,000. This recent increase in employees may indicate a period of business growth, expansion, or strategic changes that require a larger workforce to support the company’s operations.

Goodyear tire performance statistics

- Rolling resistance of the global consumer tire portfolio has decreased steadily since the 2005 baseline, with a 32% reduction in 2019, 31% in 2020, and 29% in 2021.

The weight of the global consumer tire portfolio has also been reduced since the 2005 baseline, with an 8.8% reduction in 2019, 8.2% in 2020, and 7.7% in 2021.

The 2019 data on weight reduction was misstated in Goodyear’s 2020 Proxy Statement, and the correct number is now provided. Health and safety impacts have consistently been assessed for 100% of product categories in the years 2019, 2020, and 2021. There have been zero total incidents reported in the years 2019, 2020, and 2021.

Goodyear product quality statistics

- Warranty cost per net sale has shown improvement from 2019 to 2021, decreasing from 0.22% in 2019 and 2020 to 0.17% in 2021.

Quality certification has been consistently maintained, with 100% of plants having quality certification (ISO 9001, IATF 16949, etc.) in 2019, 2020, and 2021.

The number of product recalls has only been reported for the 2021 performance period, with 2 recalls issued during that time.

The number of units recalled is also only available for the 2021 performance period, with 1,447 units recalled during that year.

Goodyear goals

Goodyear Tire & Rubber prioritizes the production of high-quality, safe, reliable, and durable products. The company heavily invests in research and development to generate innovative products that address the changing needs of its customers. By introducing new materials, technologies, and designs, Goodyear aims to drive innovation within the tire industry.

Additionally, Goodyear is dedicated to creating sustainable tires that minimize environmental impact and enhance fuel efficiency. To increase its global presence, the company plans to expand its market share in existing markets while exploring new markets. Leveraging its strong brand reputation and quality products, Goodyear seeks to attract new customers and foster long-lasting relationships.

Furthermore, the company is committed to improving the customer experience by offering top-quality products, exceptional service, and support. To achieve this, Goodyear intends to invest in digital technology to enhance its e-commerce capabilities, streamline operations, and deliver more personalized customer experiences.

Lastly, Goodyear focuses on boosting operational efficiency by implementing lean manufacturing practices, optimized supply chain management, and cost reduction. By investing in automation and digitization, the company aims to increase efficiency and minimize waste, ensuring continued success in the tire industry.

Sources

- “Goodyear Financial Reports”. Goodyear, 2022, https://corporate.goodyear.com/us/en/investors/financial-reports.html

- “Goodyear Annual Reports”. Goodyear, 2022, https://corporate.goodyear.com/us/en/investors/financial-reports/annual-reports.html

- “Goodyear 2021 Corporate Responsibility Report – Tire Performance”. Goodyear, 2021, https://corporate.goodyear.com/content/dam/goodyear-corp/documents/responsibility/esg-reports/GD_CRR_2021_TirePerformance.pdf

- “Goodyear ESG Responsibility”. Goodyear, 2021, https://corporate.goodyear.com/us/en/responsibility/esg.html#

- “Goodyear Tire & Rubber Gross Profit”. Macrotrends, https://www.macrotrends.net/stocks/charts/GT/goodyear-tire-rubber/gross-profit

- “The Goodyear Tire & Rubber Company”. Encyclopedia, https://www.encyclopedia.com/books/politics-and-business-magazines/goodyear-tire-rubber-company-0